Basic Indicator Approach Vs Standardised Approach . Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Under the basic indicator approach, the capital requirement for. Web part 1 — basic indicator approach. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web alculating the operational risk capital requirement within basel ii. The basic indicator approach (“bia”); Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital.

from slideplayer.com

Web part 1 — basic indicator approach. Under the basic indicator approach, the capital requirement for. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web alculating the operational risk capital requirement within basel ii. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. The basic indicator approach (“bia”); Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital.

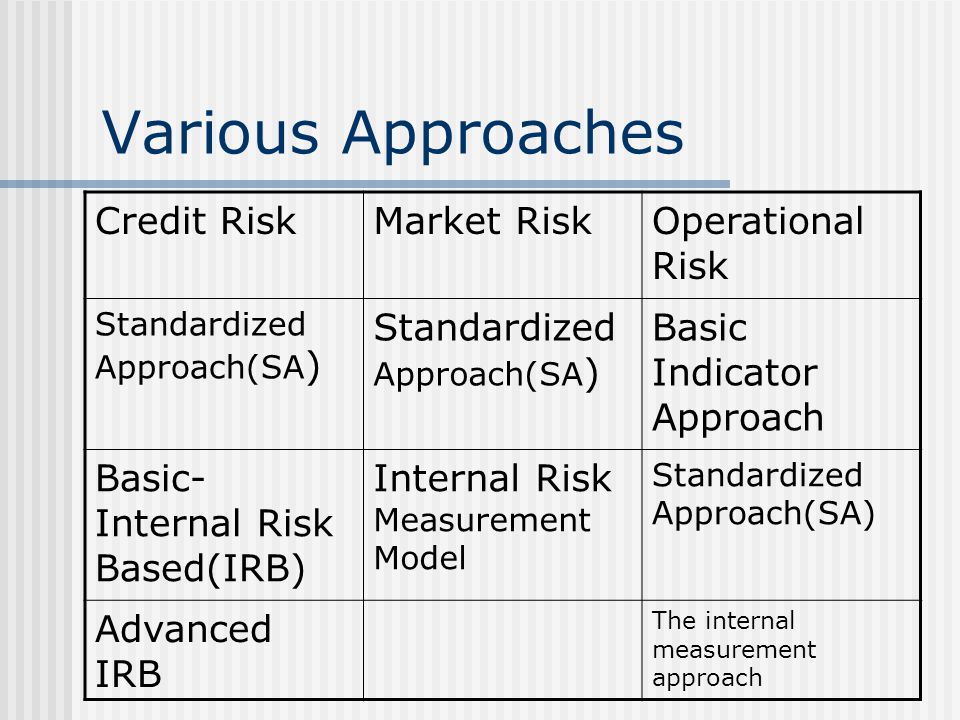

RISK MANAGEMENT PRESENTATION ON CREDIT RISK MARKET RISK AND By ppt

Basic Indicator Approach Vs Standardised Approach Web part 1 — basic indicator approach. The basic indicator approach (“bia”); Web part 1 — basic indicator approach. Under the basic indicator approach, the capital requirement for. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web alculating the operational risk capital requirement within basel ii.

From youroperationinfo.blogspot.com

Standardized approach (operational risk) Basic Indicator Approach Vs Standardised Approach Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. The basic indicator approach (“bia”); Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web part 1 — basic indicator approach. Web alculating the operational risk capital requirement within basel ii. Web the. Basic Indicator Approach Vs Standardised Approach.

From www.slideshare.net

Operational Risk & Basel Ii Basic Indicator Approach Vs Standardised Approach Under the basic indicator approach, the capital requirement for. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Web alculating the operational risk capital requirement within basel ii. Web the basel framework is the full set of standards of the basel committee. Basic Indicator Approach Vs Standardised Approach.

From docslib.org

Operational Risk, Regulatory Capital, Loss Distribution Approach, Basic Basic Indicator Approach Vs Standardised Approach Web alculating the operational risk capital requirement within basel ii. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Under the basic indicator approach, the capital requirement for. Web part 1 — basic indicator approach. The basic indicator approach (“bia”); Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web the. Basic Indicator Approach Vs Standardised Approach.

From www.slideserve.com

PPT Implementing Operational Risk in an Enterprise Risk Management Basic Indicator Approach Vs Standardised Approach Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web alculating the operational risk capital requirement within basel ii. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. The basic indicator approach (“bia”); Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs),. Basic Indicator Approach Vs Standardised Approach.

From slideplayer.com

RISK MANAGEMENT PRESENTATION ON CREDIT RISK MARKET RISK AND By ppt Basic Indicator Approach Vs Standardised Approach Under the basic indicator approach, the capital requirement for. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. The basic indicator approach (“bia”); Web the bcbs proposes three increasingly sophisticated approaches to calculating. Basic Indicator Approach Vs Standardised Approach.

From www.slideserve.com

PPT Risk Management and Regulatory Compliance PowerPoint Presentation Basic Indicator Approach Vs Standardised Approach Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web alculating the operational risk capital requirement within basel ii. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Web. Basic Indicator Approach Vs Standardised Approach.

From www.slideshare.net

Operational risk management (orm) Basic Indicator Approach Vs Standardised Approach Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Under the basic indicator approach, the capital requirement for. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web part 1 — basic indicator approach. Web this chapter describes the basic indicator approach for. Basic Indicator Approach Vs Standardised Approach.

From www.slideserve.com

PPT The Basel I and Basel II Accords PowerPoint Presentation, free Basic Indicator Approach Vs Standardised Approach Web alculating the operational risk capital requirement within basel ii. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Under the basic indicator approach, the capital requirement for. The basic indicator approach (“bia”); Web part 1 — basic indicator approach. Web the basel framework is the full set of standards of the basel committee on banking. Basic Indicator Approach Vs Standardised Approach.

From www.slideserve.com

PPT Operational Risk and the New Basel Capital Accord PowerPoint Basic Indicator Approach Vs Standardised Approach Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. The basic indicator approach (“bia”); Under the basic indicator approach, the capital requirement for. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web part 1 — basic indicator approach. Web alculating the. Basic Indicator Approach Vs Standardised Approach.

From present5.com

CAPITAL ADEQUACY BASEL 2 FINANCIAL INSTITUTIONS MANAGEMENT KIMEP Basic Indicator Approach Vs Standardised Approach Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. The basic indicator approach (“bia”); Web alculating the operational risk capital requirement within basel ii. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Under the basic indicator approach, the capital requirement for.. Basic Indicator Approach Vs Standardised Approach.

From ceemxpnu.blob.core.windows.net

Standardized Approach Example at Michael Boswell blog Basic Indicator Approach Vs Standardised Approach Under the basic indicator approach, the capital requirement for. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Web alculating. Basic Indicator Approach Vs Standardised Approach.

From kthwow.blogspot.com

kthwow Basic indicator approach and the standardized approach Basic Indicator Approach Vs Standardised Approach Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. The basic indicator approach (“bia”); Web alculating the operational risk capital requirement within basel ii. Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Under the basic indicator approach, the capital requirement for. Web. Basic Indicator Approach Vs Standardised Approach.

From docs.oracle.com

7 SAMA Basel III Standardized Approach Basic Indicator Approach Vs Standardised Approach Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. The basic indicator approach (“bia”); Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Under the basic indicator approach, the. Basic Indicator Approach Vs Standardised Approach.

From ceemxpnu.blob.core.windows.net

Standardized Approach Example at Michael Boswell blog Basic Indicator Approach Vs Standardised Approach Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. The basic indicator approach (“bia”); Under the basic indicator approach, the capital requirement for. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web alculating the operational risk capital requirement within basel ii. Web. Basic Indicator Approach Vs Standardised Approach.

From www.slideshare.net

Operational risk management (orm) Basic Indicator Approach Vs Standardised Approach Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Under the basic indicator approach, the capital requirement for. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web part 1 — basic indicator approach. Web alculating the operational risk capital requirement within. Basic Indicator Approach Vs Standardised Approach.

From bryanmmathers.com

Standards vs Standardised Visual Thinkery Basic Indicator Approach Vs Standardised Approach Web the bcbs proposes three increasingly sophisticated approaches to calculating operational risk capital. Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web part 1 — basic indicator approach. Web alculating the operational risk capital requirement within basel ii. Under the basic indicator approach, the capital requirement. Basic Indicator Approach Vs Standardised Approach.

From www.slideserve.com

PPT Operational Risk and the Basel II Capital Accord PowerPoint Basic Indicator Approach Vs Standardised Approach Web part 1 — basic indicator approach. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Under the basic indicator approach, the capital requirement for. The basic indicator approach (“bia”); Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web alculating the. Basic Indicator Approach Vs Standardised Approach.

From www.slideshare.net

Basel II Norms on Operational Risk Basic Indicator Approach Vs Standardised Approach Web alculating the operational risk capital requirement within basel ii. The basic indicator approach (“bia”); Web the basel framework is the full set of standards of the basel committee on banking supervision (bcbs), which is the primary. Web this chapter describes the basic indicator approach for calculating operational risk capital requirements. Web part 1 — basic indicator approach. Under the. Basic Indicator Approach Vs Standardised Approach.